Has the runway finally cleared? Will 2021 deliver an economic resurgence and employment recovery? Or could another disruption be lurking ahead?

Could the economy overheat? Accelerating vaccinations and the third stimulus could drive significant growth. But will it bring a wave of inflation that forces the Fed’s hand too soon? What could this mean for interest rates?

Capital rotation accelerating. Market liquidity is rising, bolstered by increasing investor confidence; what will that mean for commercial real estate and which property types will outperform?

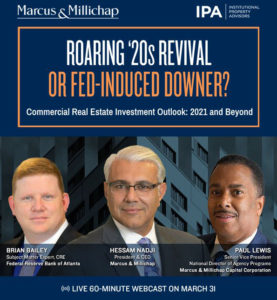

Featuring:

- Brian Bailey | Subject Matter Expert CRE, Federal Reserve Bank of Atlanta

- Hessam Nadji | President and CEO, Marcus & Millichap

- Paul Lewis | Senior Vice President, National Director of Agency Programs, Marcus & Millichap Capital Corporation