Friends and Valued Clients,

Well, this week escalated quickly. First and foremost, it is our hope and prayer that you and your families are staying safe and healthy during this unprecedented time. Because of our common interest in self storage investments, I wanted to share some takeaways from the last week’s conversations:

- It was business as usual regarding our ability to get deals moving forward and sold last week but we did hear that at least one of our competitor’s marketing campaigns was suspended to “wait and see.” Investor sentiment and appetite for self storage remains positive.

- Lending benchmarks dropped to historic lows prompting many lenders to implement “floors” on rates but liquidity for self storage deals remains cheap and robust.

- The CMBS markets remain available and healthy. However we did hear that a few conduit lenders were not quoting rates as they explore pricing.

- New construction lending has tightened substantially according to recent talks with developers.

- It’s too soon to understand the effects on rates/occupancies, but little to no impact was seen as of last week.

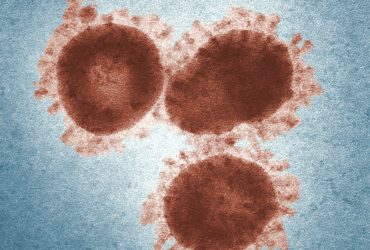

- Industry leader consensus is that stabilized stores are well positioned to weather substantial economic impact of the coronavirus in the short/midterm.

- Overall, the broader commercial real estate markets remain highly conducive for deal making. However we did hear anecdotal clips of luxury apartment and noncredit retail deals falling out of contract or missing pricing expectations this past week. Hotel lending has become restricted.

In addition, here are a few broader economic observations from our CEO Hessam Nadji’s internal briefing earlier this week:

- The US economy and the banking system were in the best shape compared to any pre-shock periods in at least the last three decades.

- Commercial and residential real estate are not the core causes of an economic or financial market problem thanks to the lack of overbuilding and overleveraging in this cycle.

- As anticipated, the Federal Reserve has already proven to be accommodative through its interest rate cut and liquidity injection of $1.5 trillion.

As always, we’re here for you. Please reach out to any of us here at The LeClaire Group if you have any concerns you want to talk through or just want to keep abreast of the latest news.

Adam Schlosser

Senior Vice President

Charles “Chico” LeClaire

Executive Managing Director