Stock Market Volatility Hits Record High;

Turbulence on Wall Street Reiterates Stability of Real Estate

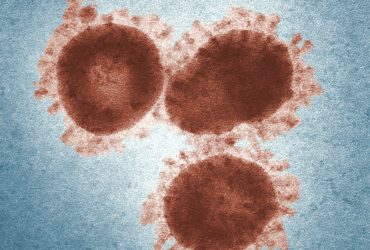

The longest bull market in U.S. history officially came to an end as coronavirus (COVID-19) related fears sent shockwaves through Wall Street. In response, the Fed took decisive action to relieve market anxiety and sustain financial market liquidity. The current volatility in the equities market reinforces the durability of commercial real estate, while record-low interest rates offer a unique financing environment for investors.

- Real estate outperformed the stock market over the last 20-years

- Historically low interest rates sparks surge in refinance activity

- Record-wide yield spreads boost levered returns

- Download a copy of this report today!